Hasierarako, ikus Credict check: Kreditu kontrola (egiaztapenak)

Segida:

Warren Molser-en Credit check1

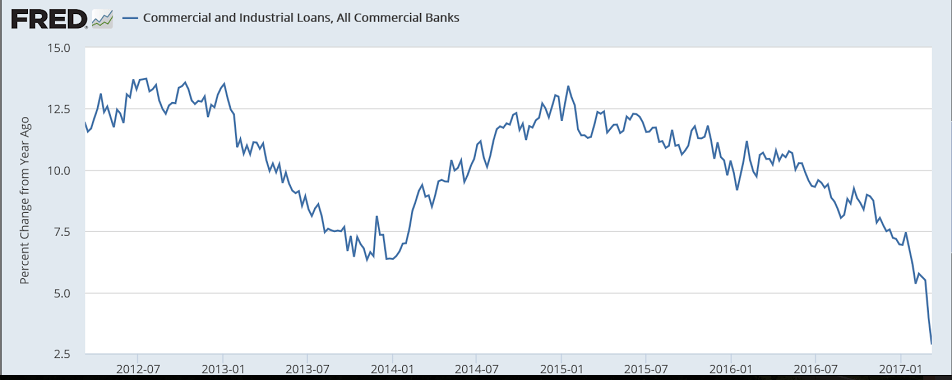

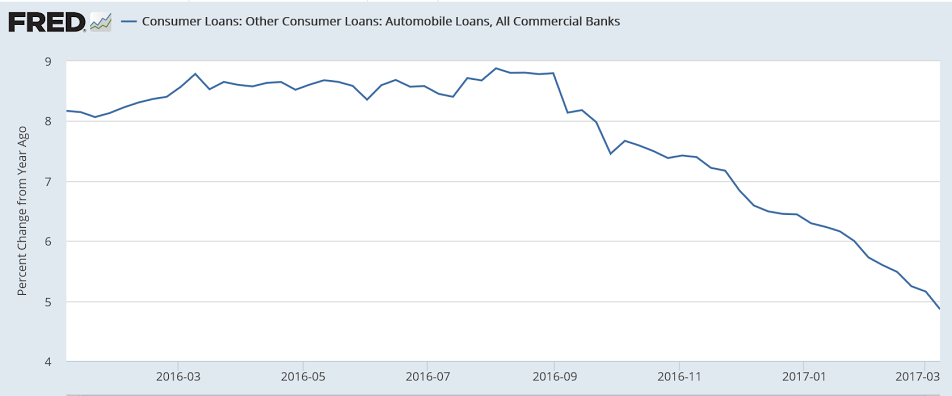

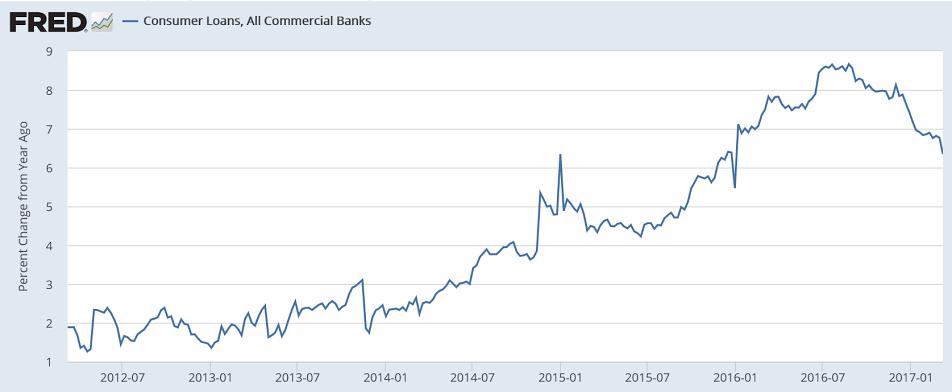

Note how it’s all been decelerating since the collapse in oil capex, and most recently the deceleration has intensified:

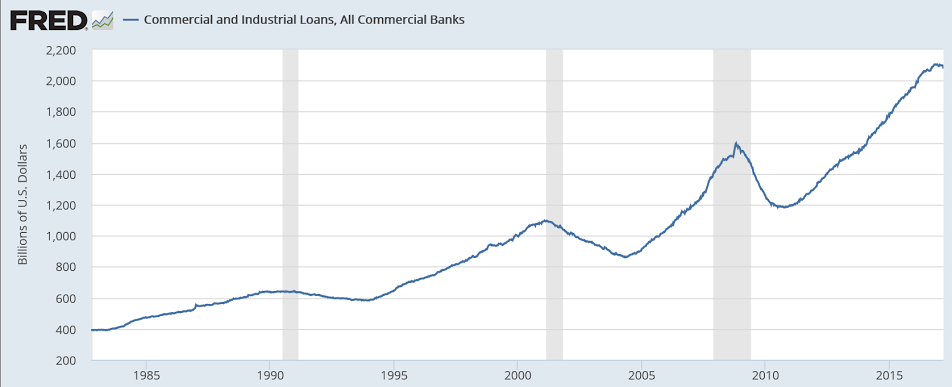

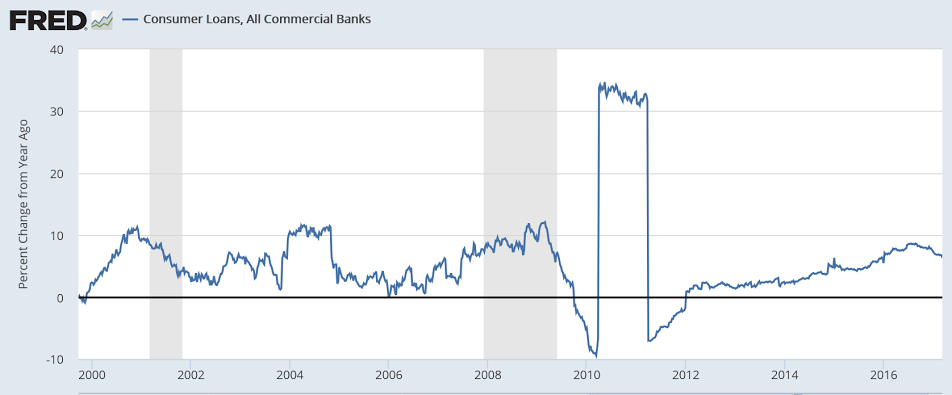

This is the absolute level of loans outstanding, which seems to only go negative like this in recessions

This is the annual growth rate which appears to be in a state of collapse:

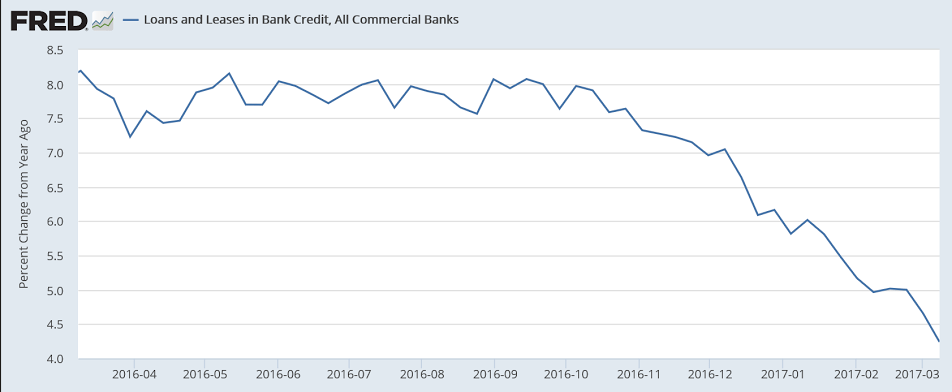

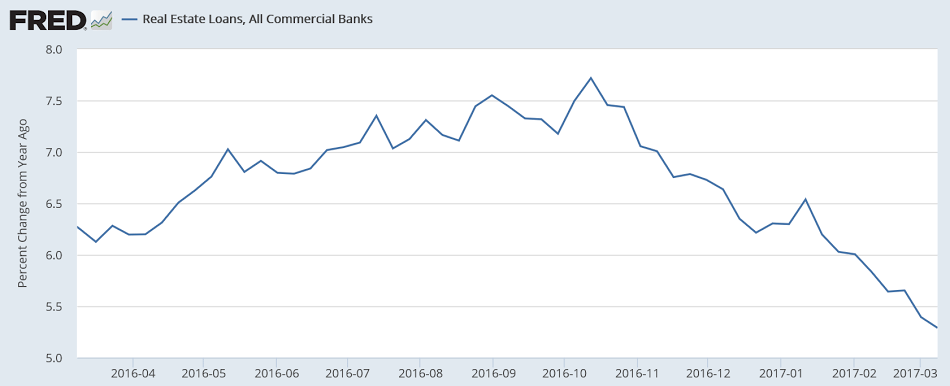

Note the pattern of accelerating into recession, then decelerating:

Gehigarriak:

(1) Tom Hickey: FRED charts. Domestic private sector borrowing continues to roll over with the pace picking up2

Warren doesn’t mention it in this post, but the trade deficit is also increasing, and the federal government fiscal balance is headed toward surplus as the administration having promised to reduce the deficit and debt.

The Fed has just raise the interest rate to 1%, which will have an offsetting fiscal effect but likely not large enough to offset the combined effect of 1) reduced domestic private sector borrowing, 2) an increasing trade deficit, which entails net saving on the part of the external sector, and 3) a tightening fiscal stance in order to impose “discipline” and reduce the public debt, which in reality is to lower aggregate nongovernment net financial USD savings

Triple sectoral balance whammy.

Commercial and industrial loans at all banks drop by $18.7 billion in a week to $2.077 trillion 4http://bit.ly/2nsc6WF

2017 mar. 20

@stlouisfed So why vote to hike rates if credit is already decelerating and at an increasing rate year over year?

4 Amerikar bilioi eta trilioi.