Hasierarako ikus Warren Mosler-en kreditu kontrola (2)

Segida:

Warren Mosler — Credit check update1

Tom Hickey:

Still not looking good.

The US is 96 months into this recovery, which is the longest and flattest on record, and it is looking long in the tooth.

And now the US is headed into what looks like a another battle over the debt ceiling, unless Gary Cohn gets his way and the Trump administration accepts some of the terms of the fiscal hawks, which would reduce the government contribution to “save money.”

That leaves exports to make up the difference. The global economic outlook is pretty iffy, too, and so reliance on net exports is not likely to pan out.

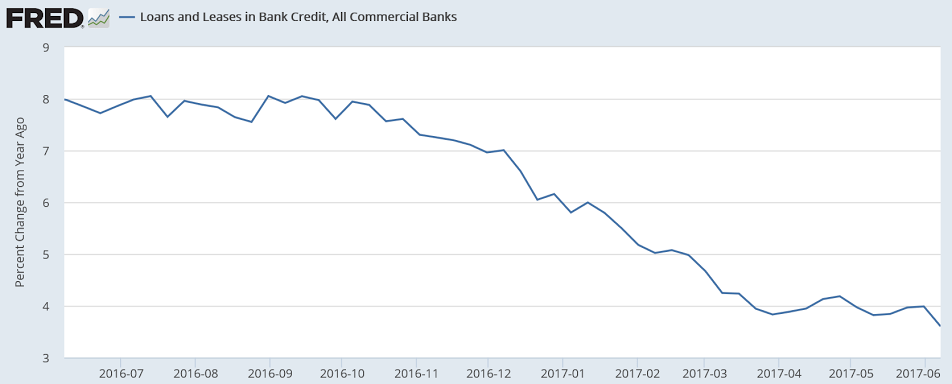

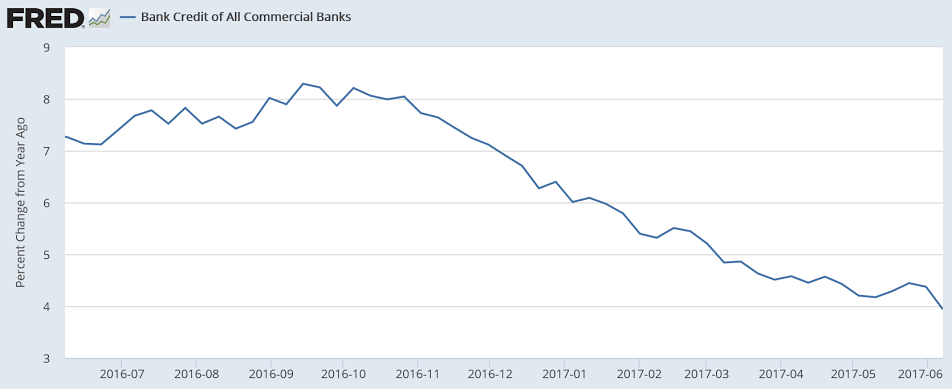

Credit check2

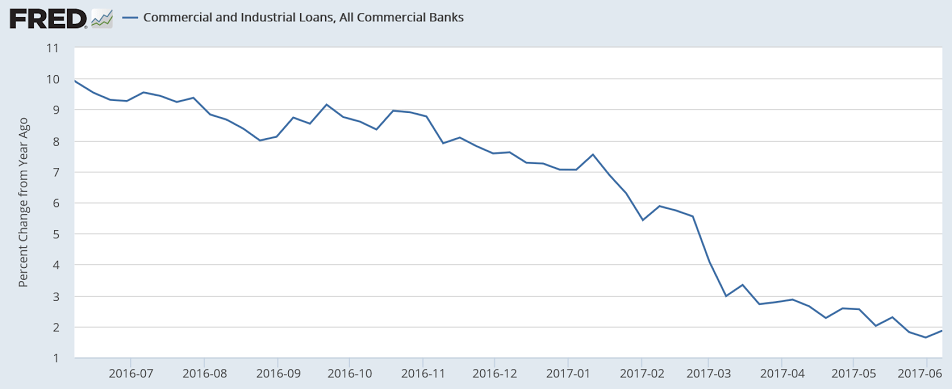

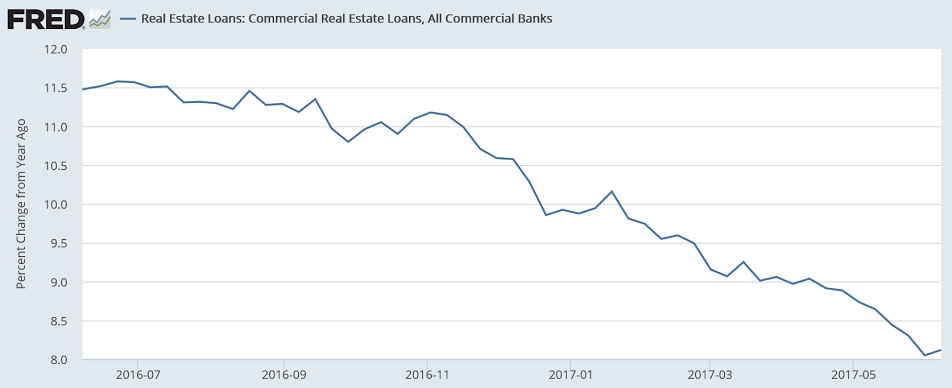

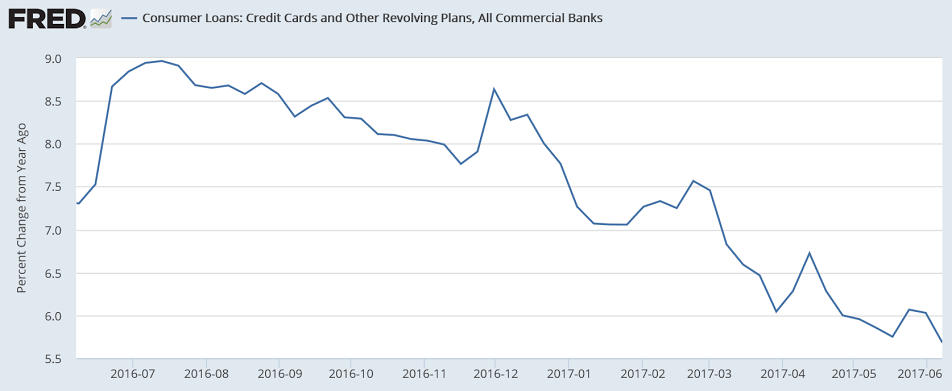

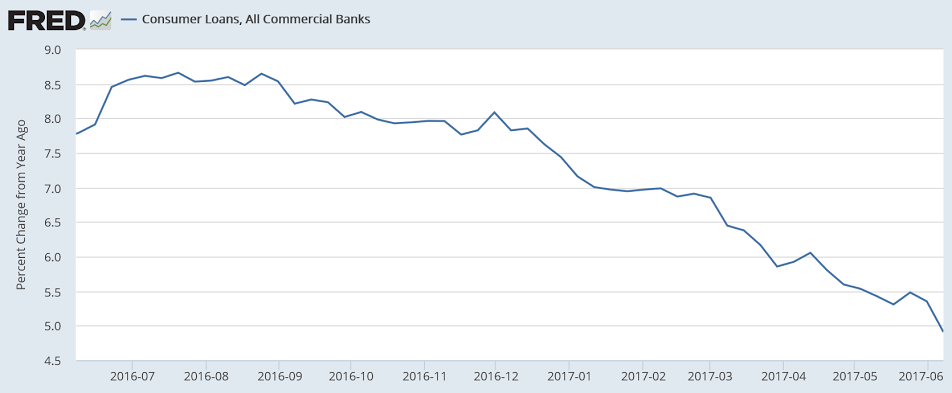

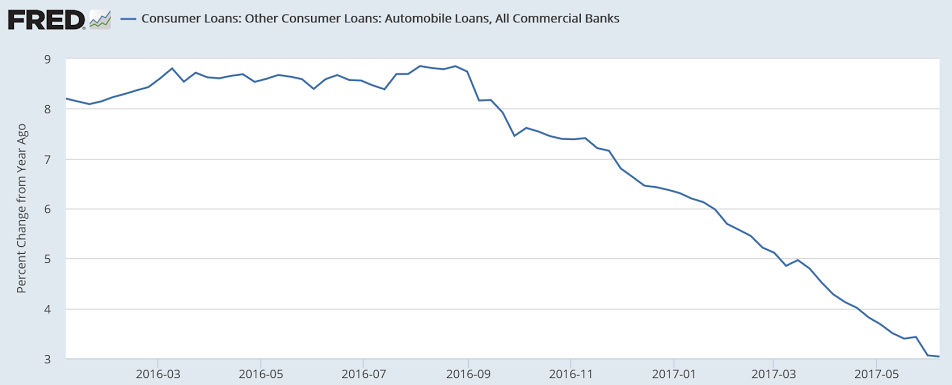

More problematic by the week. Note the absolute level of c and I loans has been flat to negative since October:

Annual rate of growth remains sub 2%:

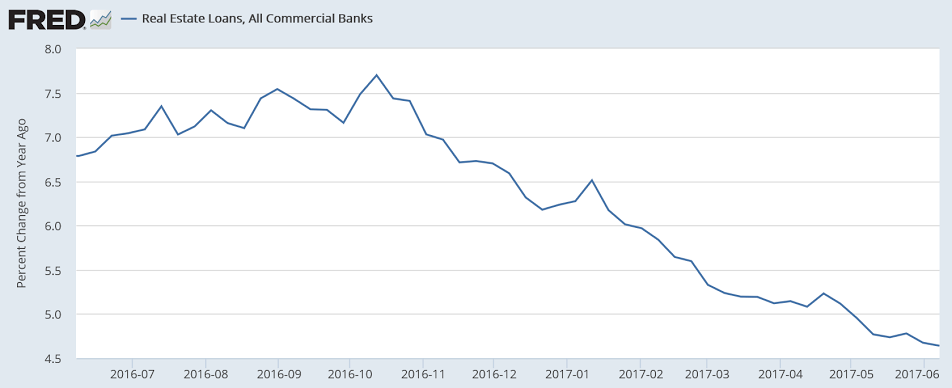

This is consistent with the weakening housing releases:

This is consistent with weakening consumer spending:

This is consistent with weakening vehicle sales:

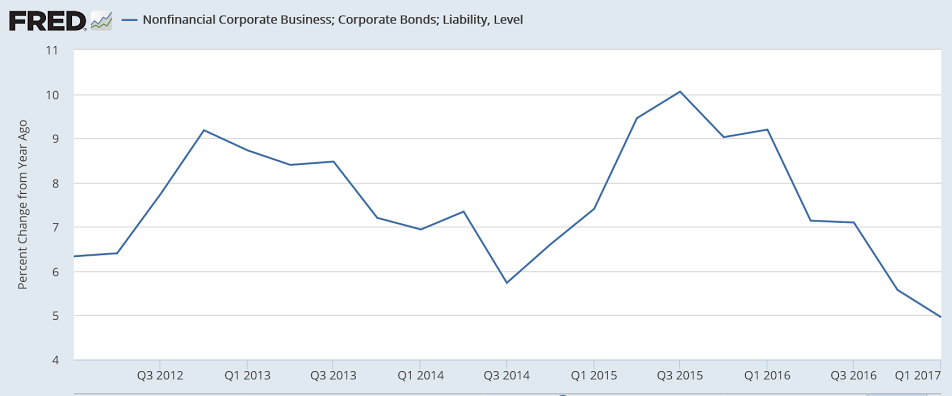

Corporate bonds are not picking up the slack- quite the opposite:

Iruzkinak:

- Matt Franko said…

- Asset value of Bank credit up about 5% YoY even with 2 rate increases over the same period totaling 0.5% …. I don’t see this as a problem…

Interest income finally on the rise probably about an additional $50B annual increase so far in interest between IOR and interest paid on T-bills and increasing….

Mike has Leading flow +28b (0.8%) over same time last year not shabby…

Fed looking at starting to let QE run off later this year which will create 100s of $billions of room on bank bs for other assets …

Could be better… need more rate increases and draw down of the QE to get going…

- MRW said…

- People need jobs, Matt. Financial indices aren’t going to move the economy.

- Warren Mosler said…

- Bank credit contribution to growth this year a lot less than last year.

- Greg said…

- Matt sounds like Scott Sumner more and more everyday, except Sumner hates Trump.

Matt the monetarist

- Matt Franko said…

- Greg, I’ve only pointed out the small but still positive changes in flows not munnie supplies or anything monetarist…

Our only hope of getting out of this low growth environment is via automatic appropriation e.g. higher interest income from higher policy rate and a reversal of QE helping out banks do more financing of output assets … those seem to be starting

Everyone except the 1,000 or so of us thinks “we’re out of money!” hello….

- Matt Franko said…

- MRW,

I didn’t mention anything about financial indexes…

Increased interest income from from higher rates will result in higher expenditure and some employment increases… states (like Illinois) will get well too and be able to do more purchases…

Financial indexes will go up ex post of the increases in incomes… it’s not stochastic or complicated….

- Matthew Franko said…

- Tom from your link:

“Not only is the average annual growth rate of just 1.48% during Obama’s business cycle the weakest of any expansion since at least 1949, he has just become the only President to have not had even one year of 3% GDP growth.”

He was the only president to have ZIRP foisted upon him his whole 2 terms also… growth, as a function, has the policy rate in the numerator of one of the terms of the equation…

dont blame Obama or the “business cycle!” (‘cycle’ sounding very stochastic here)

- Tom Hickey said…

- He was the only president to have ZIRP foisted upon him his whole 2 terms also… growth, as a function, has the policy rate in the numerator of one of the terms of the equation…

Matt, citing one potential factor with the implication that it is a major cause without providing substantiation is magical thinking. It’s a narrative and not a scientific explanation.

The problem in pseudoscience is choose your narrative and then argue with others with lots of handwaving but without providing compelling evidence.

- Tom Hickey said…

- Greg, I’ve only pointed out the small but still positive changes in flows not munnie supplies or anything monetarist…

But the point is where the interest payments are flowing and what happens then. If saving desire is still higher then spending desire (consumption and investment) at the macro level, then the flow will likely have little to no effect on growth.

- Tom Hickey said…

- Increased interest income from from higher rates will result in higher expenditure and some employment increases… states (like Illinois) will get well too and be able to do more purchases…

Financial indexes will go up ex post of the increases in incomes… it’s not stochastic or complicated….

Yes, it is complicated. If the increase flows to spending, then more growth. It is flows to saving, then no growth. So the ratio of saving to spending must be known rather than just assumed.

Moreover, there are seldom single causal factors in social situations, which is why it is difficult coming up with linear equations and writing functions in social science including economics.

One could do a statistical analysis of similar situations in the past to arrive at a probability distribution but it would be an estimate. Likely more accurate than a guess though, with the caveat that past performance is no guarantee of future performance.

- Tom Hickey said…

- I should qualify the statement, “Moreover, there are seldom single causal factors in social situations, which is why it is difficult coming up with linear equations and writing functions in social science including economics,” with the proviso that the outcome conforms to reality based on data.

Social scientists and especially economics simply their assumptions to make the math tractable and fit with their priors all the time, But the results are generally disappointing when compared with reality.

Not to worry though. Collecting data and processing it into useful information is difficult at the macro scale, so they are not caught out until embarrassing turning points when they get caught with their pants down.

- Matt Franko said…

- Tom, Functional equations often have more than one term and multiple variables…

State and local govts will spend any increase in govt interest income they get on their erisa accounts $4$ until the accounts become over funded … this will take a while …. so will modest income savers…

You guys are the ones who keep saying everything is going to hell meanwhile it isn’t happening … I’m telling you here why it isn’t happening the system is being provisioned with modest yoy3 increases of Treasury withdrawals so we will continue to see modest measures of growth…

- Tom Hickey said…

- Matt, I am not saying your are wrong. I am waiting for your to spell out the argument so that is more than a narrative. I have shown ways that the narrative can be attacked, while you say it is not complicated. If it’s not show it with more than more narrative.

I appreciate that this takes time that you may not wish to devote to this, or sharing research that is proprietary. Those are good reasons, but then the claim remains an unsubstantiated assertion supported only by narrative.

This is an important claim, however, since it would radically revise current thinking. So I am pushing you on it. You are the one taking about competence, being qualified, writing deterministic functions, etc. So I am saying put up or shut up. : )

- Warren Mosler said…

- I was born in 1949…

Also, a positive policy rate is basic income for those with money…

😉 - Matt Franko said…

- Tom it always has to start this way

https://en.m.wikipedia.org/wiki/Fermi_problem

“Scientists often look for Fermi estimates of the answer to a problem before turning to more sophisticated methods to calculate a precise answer. ”

It’s good enough for now, let’s see what happens we’ve had almost 10 years of zirp/QE and high savings resulting in tepid growth now let’s see what happens to growth as the zirp and QE is reversed leaving other fiscal areas slightly up to flat….

If we return to higher levels of growth then it would be worth more formal documentation…

Zirp/QE has certainly not led to decent growth in prices or output like the monetarist people claim it would….. just the opposite…

- Tom Hickey said…

- That’s post hoc ergo propter hoc aka questionable cause. It is an informal fallacy.

It’s another way of asserting something without showing substantiation.

Correlation is not causation.

To put it in your terms, where’s the determinism?

This requires showing a transmission mechanism, and I have offered objections to a simple linear model above. The flow can go in different directions that will influence the effect.

- The Rombach Report said…

- Warren Mosler said…

“Bank credit contribution to growth this year a lot less than last year.”

Warren – Happy Father’s Day!

- The Rombach Report said…

- Matt Franko said…

“Our only hope of getting out of this low growth environment is via automatic appropriation e.g. higher interest income from higher policy rate and a reversal of QE helping out banks do more financing of output assets…”

Matt – Flattening yield curve in the face of Fed rate hikes suggest the economy is losing traction. The Trump election has fueled 20% stock market gains on expectations for large fiscal expansion from tax cuts, defense & infrastructure spending, all of which is looking more doubtful now. Maybe it wouldn’t be the worst thing in the world for the Fed to hold off on further rate hikes until that policy agenda gets back on track.

- Matt Franko said…

- The transmission mechanism is govt crediting non non govt bank accounts…

- Matt Franko said…

- Tom I could demonstrate osmosis to you and the change in concentration across the membrane and you would say “where is the evidence!”…

- Tom Hickey said…

- The transmission mechanism is govt crediting non govt bank accounts..

That is saying that income leads to spending detemninisticallly. There are several issues with that.

First, income is either spent or not spent (saved). The portion that is saved doesn’t become someone else income and has no effect on growth. So the ratio of saving to spending is important here and that ratio is variable, determined by the liquidity preference those receiving the income.

Current low interest on the longer end of the yield curve would suggest that saving desire is still elevated. In addition, the one bright spot is financial investment in equities not to be confused with primary investment in production. The presumption is that a significant portion of an increase in income will flow into equities, which falls under saving.

Secondly, spending flows into different channels that have different economic effects, so affecting growth more than others. For example, the multiplier effect of productive investment is higher than consumption.

Different types of consumption and investment also have different effects. For example, its’ possible that Silicon Valley does very well as a result of the increased injection but the rest of the economy not so much.

- Tom Hickey said…

- Tom I could demonstrate osmosis to you and the change in concentration across the membrane and you would say “where is the evidence!”…

I am not asking for evidence but a fleshed out explanation that can be tested.

In the osmosis example, you would explain the theory and the mechanism behind it, and show how evidence supports it and no evidence contradicts it. You would further point out that the explanation is comprehensive, internally consistent and consilient with the rest of scientific knowledge, corresponds to evidence, is useful and economical. Moreover, there is no competing theory. As a result, I would agree that is is the best explanation.

You have not made that case wrt your claim.

-

3 Year Over Year – YOY.